What if I tell you there is a convenient way to secure a loan without the drama involved. All you need is your smartphone you are good to go.

Securing a loan from a bank is something not all Filipinos can afford. They ask for a lot of bank documents and records and even ask for collateral.

Asking a friend for a loan creates more drama, it becomes not just a financial loan but an emotional loan a.k.a. “utang na loob”.

You can read about where Filipinos borrow money here https://www.spot.ph/newsfeatures/humor/sources-pinoys-like-to-borrow-from-adv-con

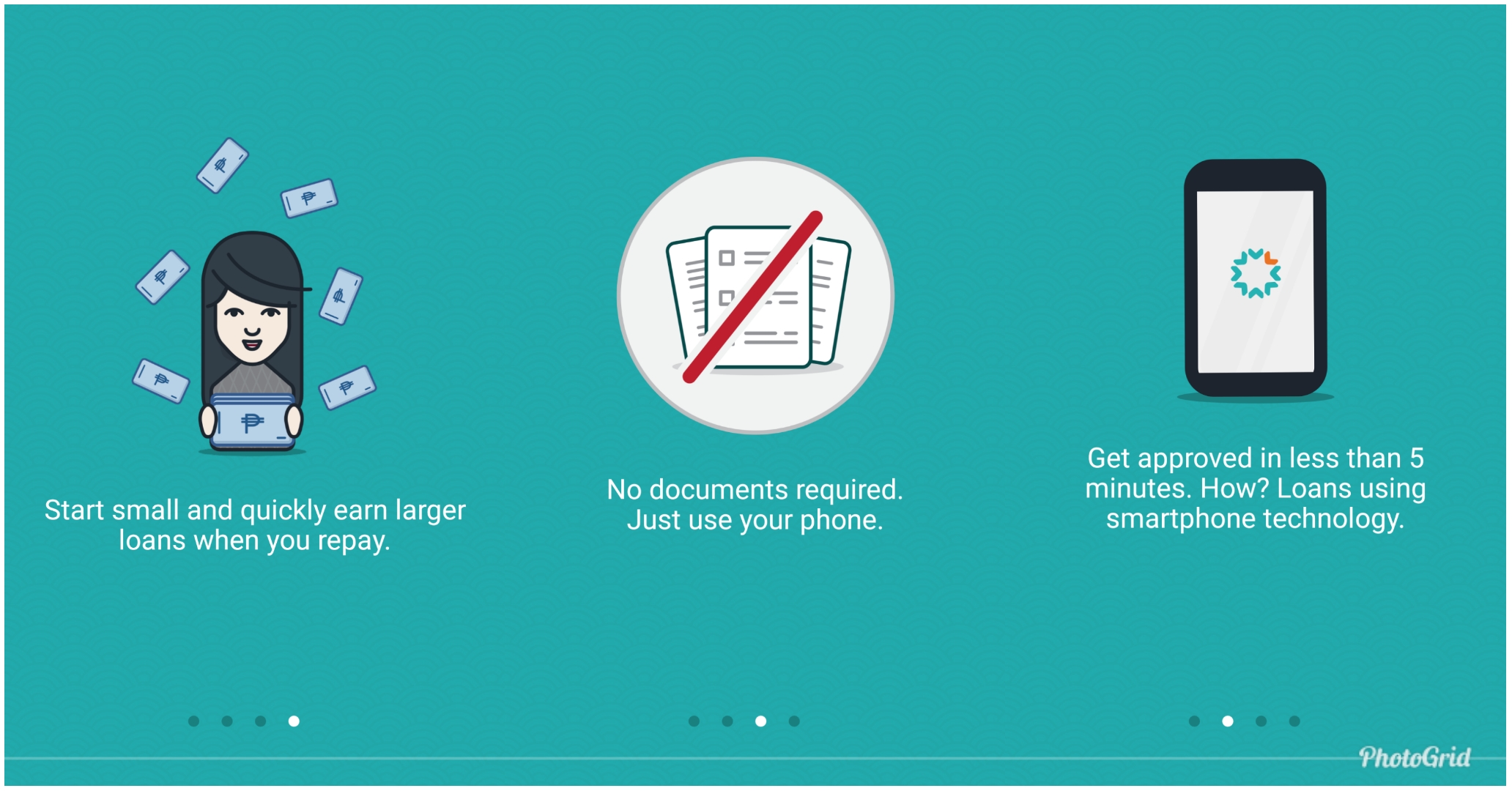

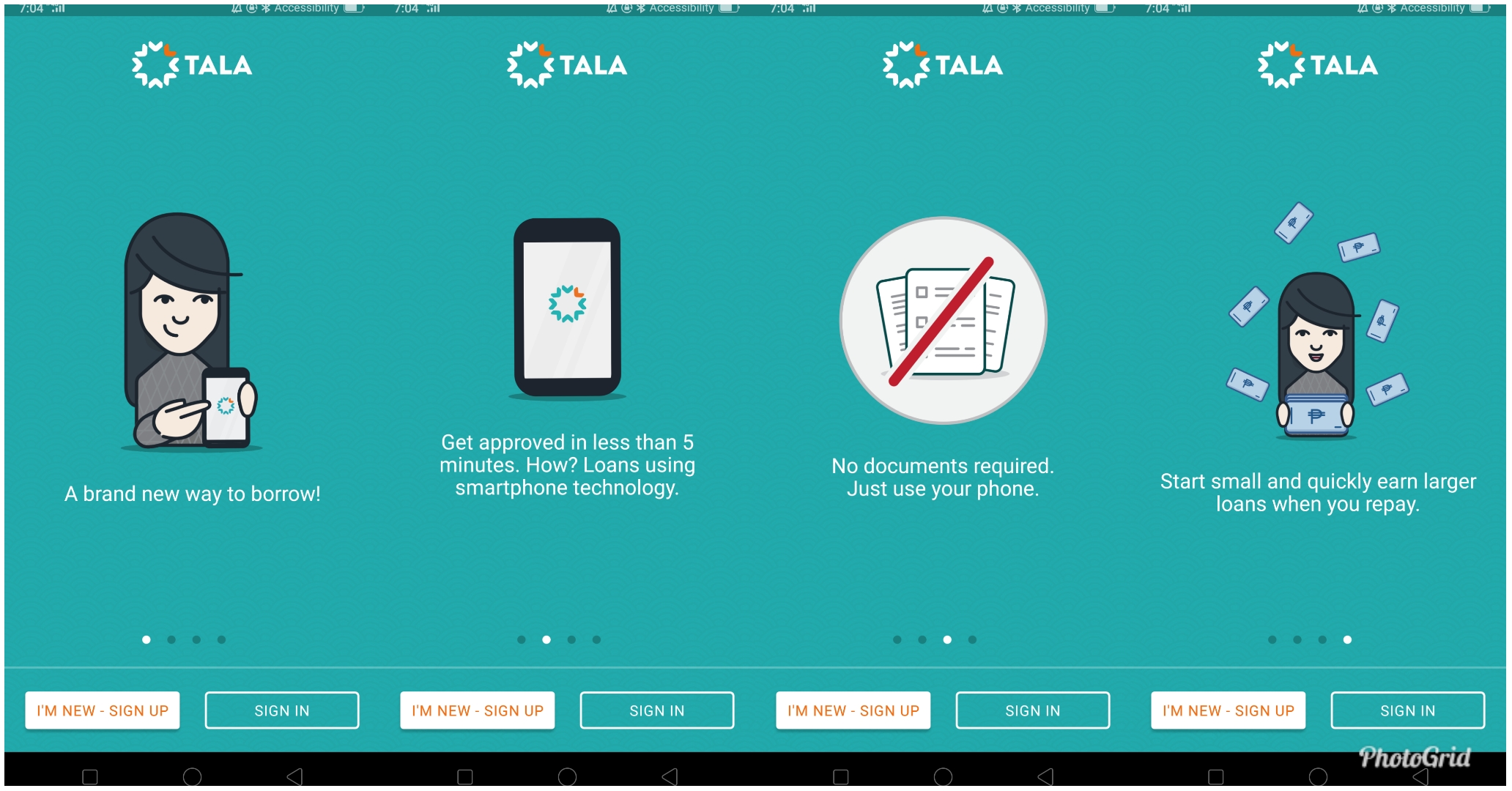

Here comes TALA app. TALA is an app that provides loans without the need for bank or credit records. The app uses smartphone data to gauge credibility, allowing approval of your loan within the day (if the loan process was done during a working day).

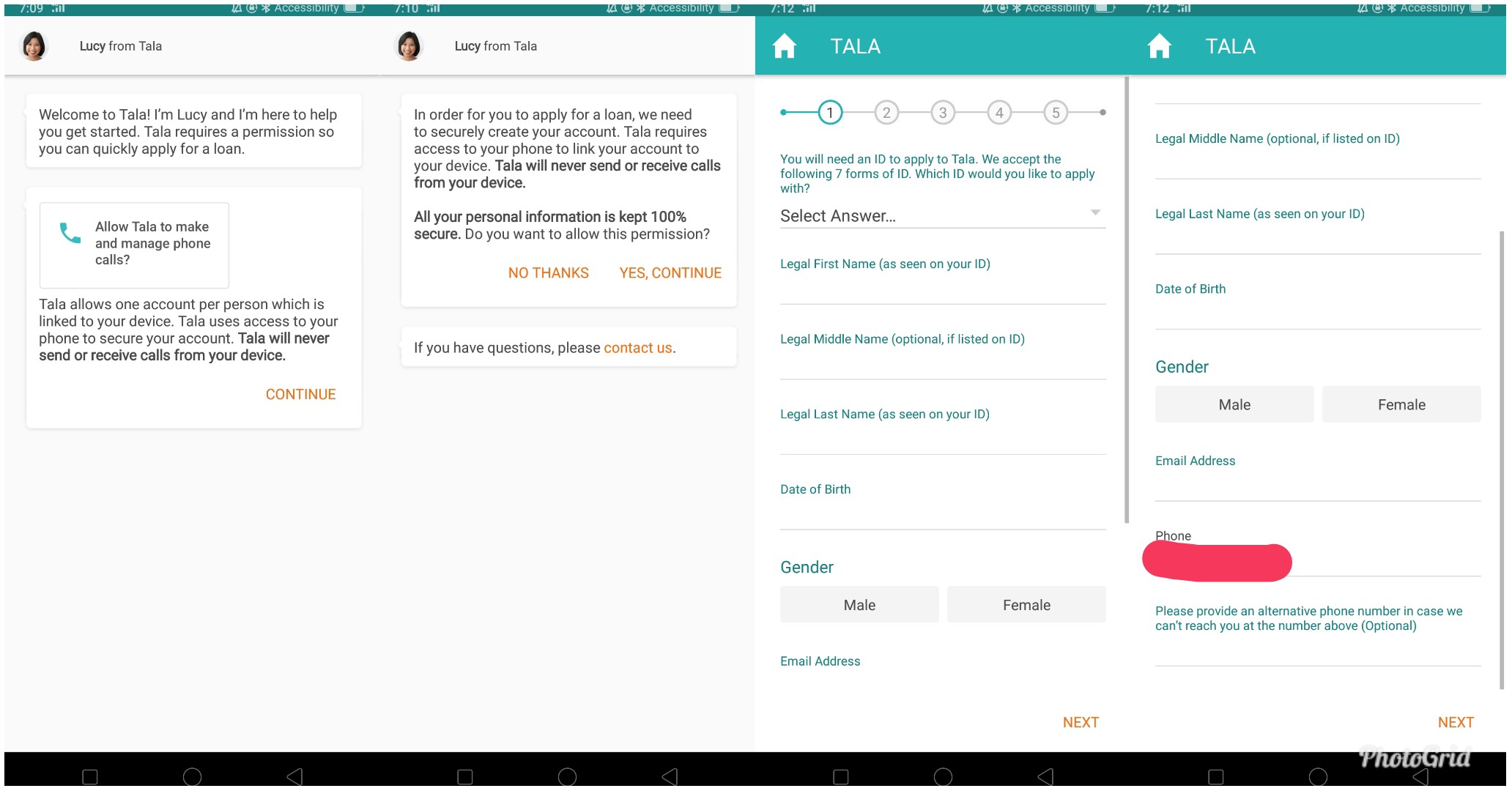

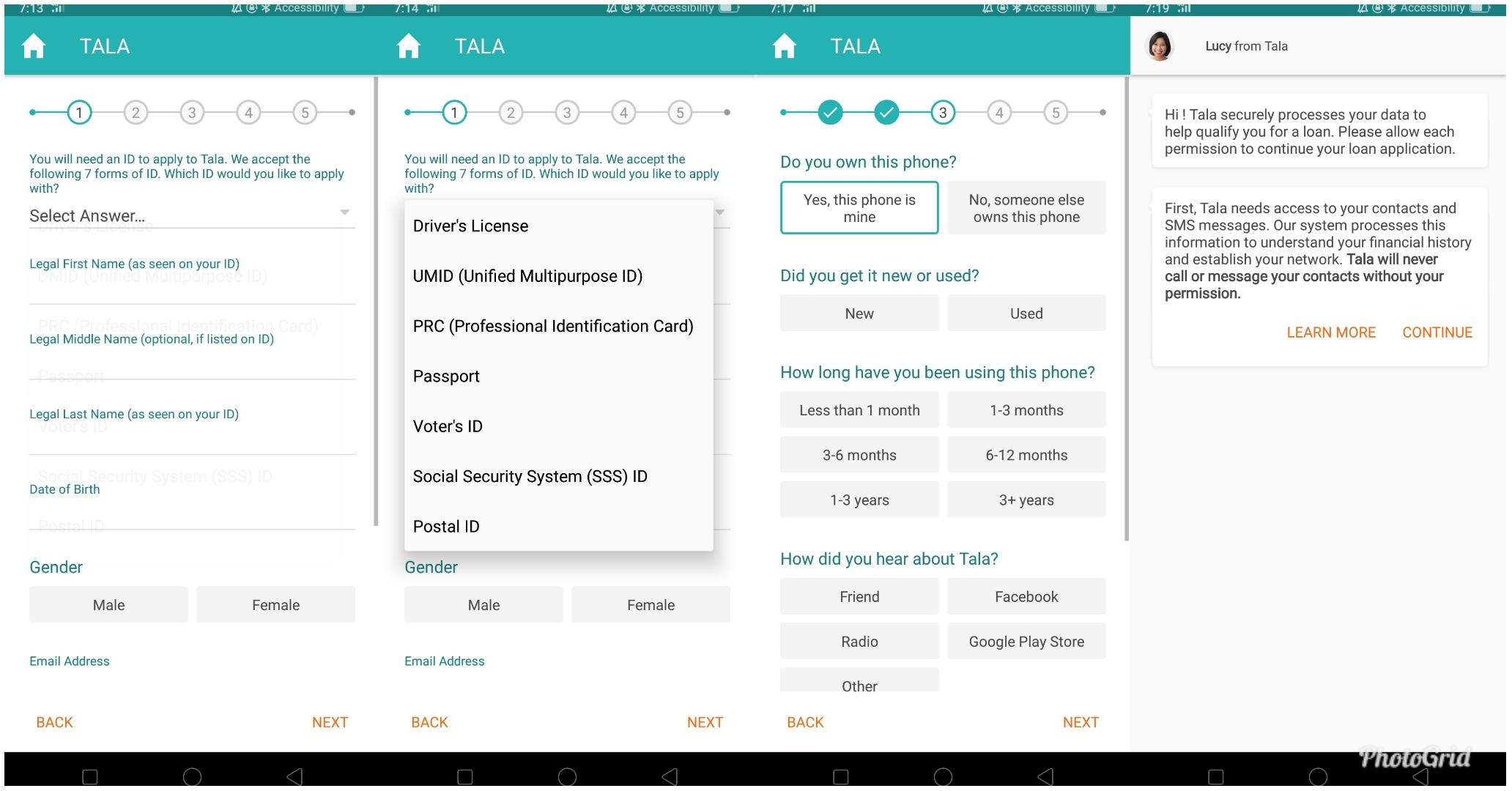

Just to see how the process goes, I tried the Tala app myself. I did have some hesitations with the gathering of my contacts and messages but I wanted to do a comprehensive review so I went through with the process of securing a loan.

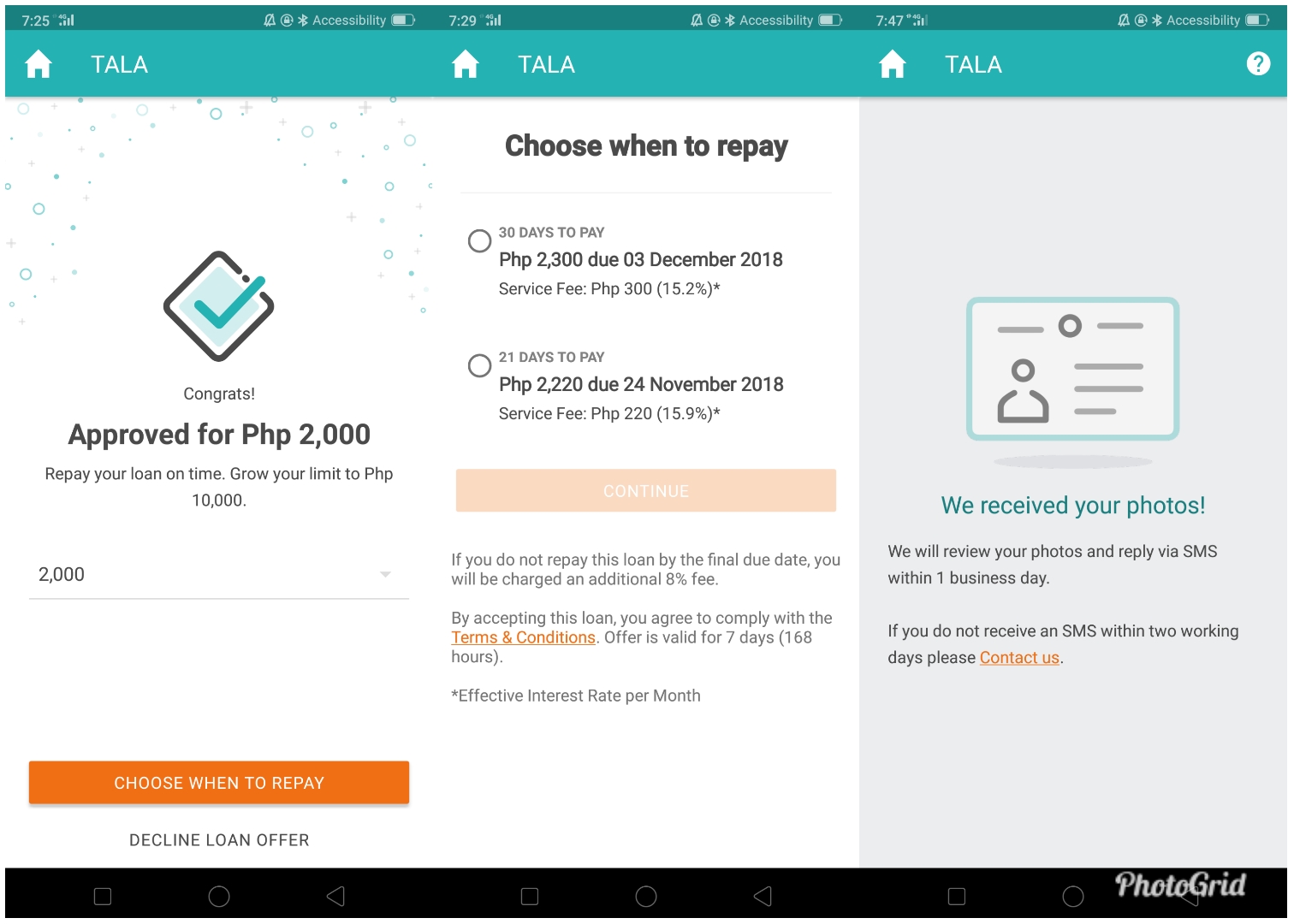

Below are screencaps of the entire process

Let the photos below show you the Tala app lending process goes:

Getting approved for the loan

The Tala financial app approved me for the first time to get a Php2,000 loan. The interest for 30 days is 15.9 percent which means I will pay Php2,300. Since I opted to receive my loan through a money remittance center a service charge of Php100 will be deducted from my loan amount. This means I will be taking home Php1,900 and will be paying them back Php2,300.

The interest seems very steep compared to credit cards but the good thing about this kind of loan is that you build your credit history and credibility. You can pay earlier than your deadline and build a good credit standing which will make you eligible for the higher loan amount.

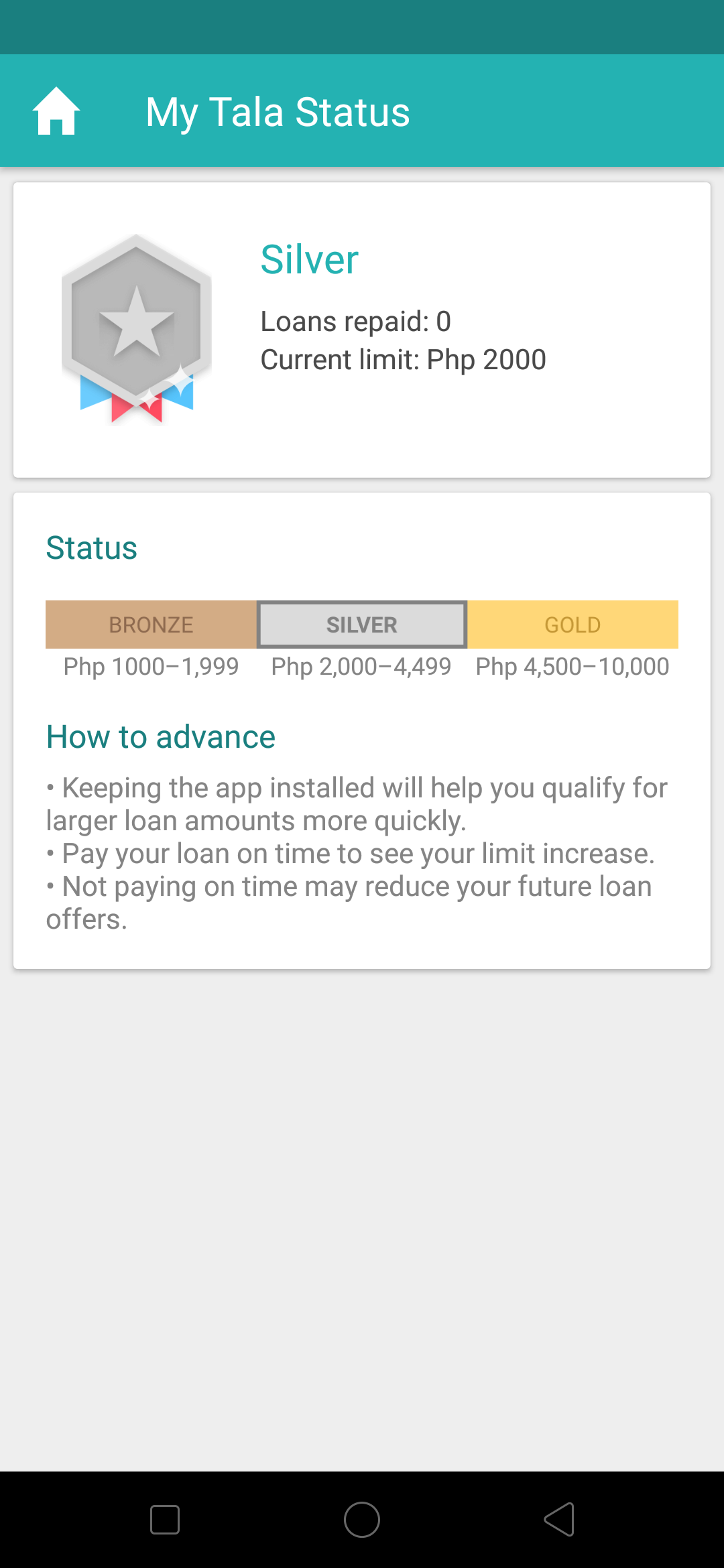

Looking at my records with Tala, I was categorized as a Silver member. Which means I was approved for a higher amount for a first-timer. The highest loan you can secure from Tala is Php10,000.

Getting the money

I proceed with securing the loan at Tala and within 24 hours I , I was able to get the money I borrowed from them .

They sent me a text message that my money is ready for pick. Within 10 minutes from getting the notice I got my money from their partner remittance center without fuss. I just went the usual standard procedure of receiving money. You need a valid government ID if you will redeem at a remittance center .

There is an option to have it deposited to your bank with no service charge or get it at a money remittance center that will charge a service charge depending on the amount you are getting.

Payment can be done at 711. You can pay right before your deadline or pay on time. Both ways will make your loanable amount increase. If you fail to pay on time you will incur an 8% additional penalty on top of the 15.% plus interest.

Honestly, I like how this app works it is more convenient than traditional borrowing channels.

Would you like to try this lending app? You may download the Tala App here Let me know if you did! Hi! Tala is a fast and easy way to borrow money that I use and trust. Download Tala to join me and millions of other users today!